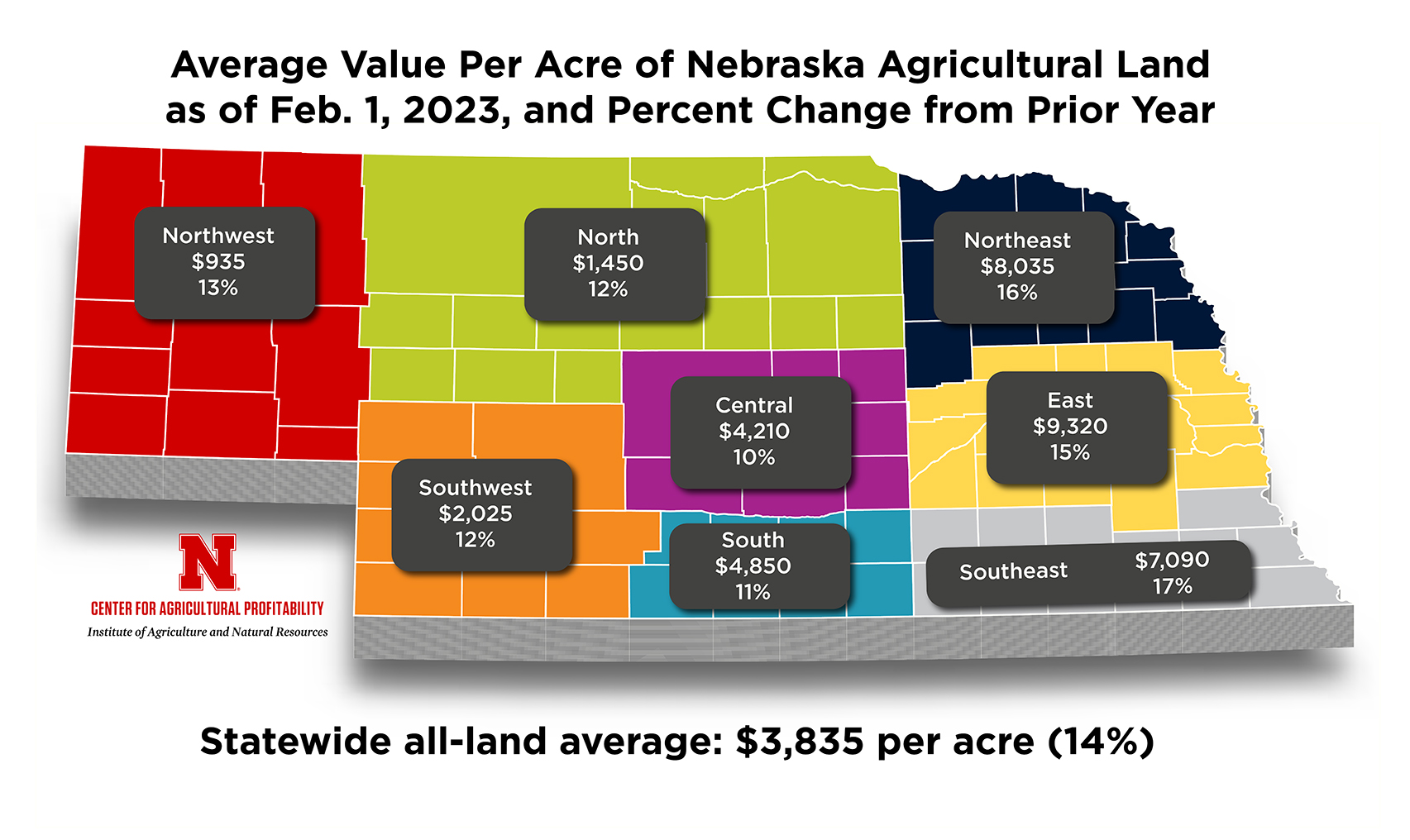

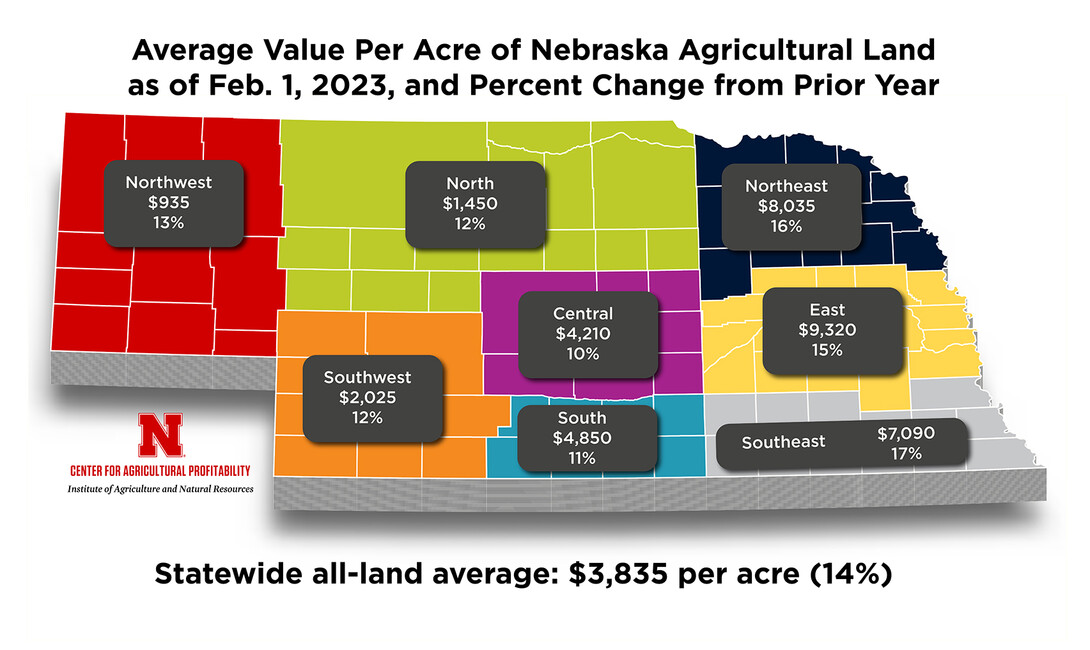

The market value of agricultural land in Nebraska increased 14% over the prior year, to an average of $3,835 per acre, according to the University of Nebraska–Lincoln’s 2023 Nebraska Farm Real Estate Market Survey preliminary report. This marks the second-largest increase in the market value of agricultural land in Nebraska since 2014 and the highest non-inflation-adjusted statewide land value in the 45-year history of the survey.

The report is issued annually by the university’s Department of Agricultural Economics and Center for Agricultural Profitability. It is based on a survey of land industry experts across Nebraska, including appraisers, farm and ranch managers, agricultural bankers and other industry professionals.

The survey attributes the rise in agricultural real estate values to higher commodity prices, purchases for operation expansion, favorable financial situations for current owners and an increase in buyers acquiring land as a hedge against inflation.

Increases in crop and livestock prices contributed to a net farm income of more than $8 billion in Nebraska in 2022, even as expenses for inputs like fertilizer and fuel increased by more than $3 billion over the prior year in the state. But record-low interest rates at the beginning of 2022 rose to their highest points this decade by the end of the year. This may impact agricultural real estate markets in the coming year, according to Jim Jansen, an agricultural economist who co-authored the survey and report.

“Monetary policy in 2022 created a dynamic period as the Federal Reserve raised interest rates to combat inflation,” Jansen said. “Interest expenses for land loans gradually rose over the prior year and into 2023 as the Federal Reserve continues policies to decrease inflation.”

He added that low interest rates on loans in early 2022 and concerns about inflation fueled demand for investment in land, a tangible asset that helps to hedge purchasing power, noting that operators and investors use land purchases when evaluating hedges against inflation and to grow farms and ranches.

The survey reports market values on seven types of land by region across Nebraska, as well all-land average values for the entire state. Dryland cropland with irrigation potential experienced the largest statewide increase on cropland, up 16% for all land classes. Increases between 17% and 21% led the category in the northeast, southwest and southeast districts. The estimated value of dryland cropland without irrigation potential rose 13% across the state, with the largest gains — between 15% and 21% — reported in the northwest, south and southeast districts.

Center pivot-irrigated cropland averaged 13% higher, with the northeast, east and southeast regions leading Nebraska in market value increases between 14% and 19%. The value of gravity-irrigated cropland rose 12% across the state, including gains between 14% and 20% in the east and south regions.

The gain in statewide grazing land and hayland market values ranged from 14% to 17%. Hayland led at 17%, as operators competed for additional acres during expansive drought across the state. Nontillable grazing land followed hayland with an increase of 15%. Major grazing regions in the northwest, north, central and southwest led the gains, ranging from 13% to 20%. Cow-calf producers competed for grazing properties during the drought, and tillable grazing land also trended higher at 14% across the state.

Cash rental rates for dryland cropland rose between 7% and 11% across the state, which survey responses attributed to challenges related to drought, input expenses and water availability. Pasture and cow-calf pair monthly rental rates trended steady-to-higher across Nebraska, rising between 6% to 7% over the previous grazing season.

“Extensive drought in major grazing land areas poses a threat if we don’t see additional rainfall this upcoming grazing season,” Jansen said. “The cash rental negotiations should include early removal provisions when accounting for drought considerations.”

The 2023 Nebraska Farm Real Estate Market Survey preliminary report is available here. The final report is expected to be published in June.